If you have sustained damage to your roof, siding, windows or even just gutters, it often makes sense to file a claim with your homeowner’s insurance. The most common cause of damage to your roof is severe weather. Whether high winds, damaging hail, or even downed trees, any damage caused by weather may qualify you for insurance coverage. You may also be eligible for coverage based on mammal damage, though rodent damage is usually excluded, so racoon damage will be covered, but squirrel damage would be excluded. The actual insurance term for this type of event is an “act of God.” If you believe that you may have sustained storm damage the first step is usually to get a contractor to inspect your property and determine if there is enough damage to justify a claim. Craftsmen Roofing & Exteriors does offer no-cost, no-obligation inspections.

Filing an insurance claim.

Once you have established that your home has sustained damage the next step is to file a claim with your insurance carrier. This process varies slightly depending on the specific carrier, but generally you need to either call the claims department or file a claim on an app or website. Our insurance specialists can help you through this process, but the main information that you need available is the “date of loss” meaning the date of the storm or weather event in question. It’s not a big deal if you’re not sure of the specific date, but it can be helpful. Your roofing contractor should have a valid storm date for your area. You will also need to know the type of damage sustained, typically either wind, hail, downed tree, or any combination. Once your claim is filed your insurance carrier should provide you a claim number and send the claim information over to your adjuster.

Insurance adjuster.

Your insurance adjuster is either an employee (in house adjuster) or a contractor (third party adjuster). Their job is to actually inspect the roof, siding, gutters, ecct to document the extent of the damage so that they can determine the liability that your insurance carrier has and pay out accordingly. Once the adjuster appointment is complete an in house adjuster should be able to let you know what is being covered on the spot, while a third party adjuster will have to submit the information that they gathered to your insurance for review. Regardless of what type of adjuster is assigned to your claim it’s a really good idea to make sure that you have a contractor on site for that inspection. The level of training of claims adjusters can vary dramatically and to put it bluntly it’s not in your insurance’s interest to pay out, but it is in your contractor’s interest to get the claim approved. Even if you have a good relationship with your insurance agent, agents are almost never involved in the claims process, so it’s highly recommended to have an experienced storm restoration contractor on the roof with the adjuster if at all possible.

Insurance paperwork.

Anywhere from a week to a month after the adjuster appointment your insurance will mail you a detailed estimate of everything that is approved along with how much they will pay out. At around the same time you will receive a first check from your insurance for what is called the ACV or Actual Cash Value. This is the total value of the damaged property minus depreciation. Practically if your roof is 30 years old this check will be smaller than if your roof is only 15 years old. Once the scope approved work is completed your contractor will need to notify your insurance carrier, usually in writing, that the work is done and the will release a second check for the recoverable depreciation. That is the difference between the Actual cash value and actual amount it takes to complete the work.

Common misconception about insurance claims

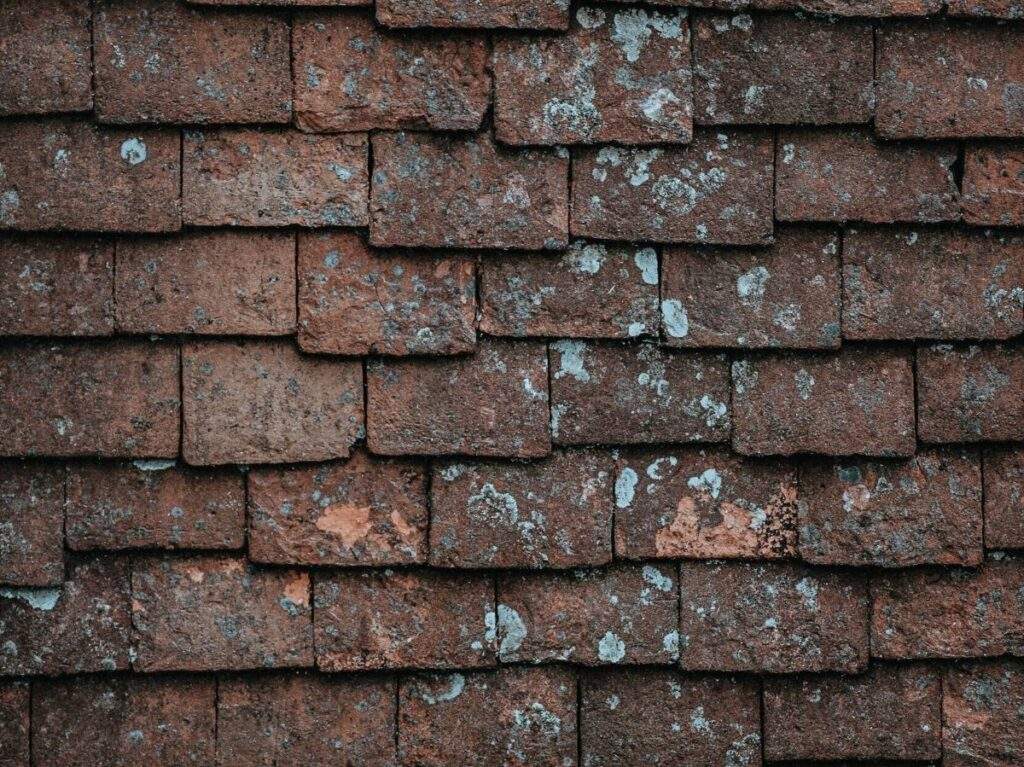

My roof or siding is too old, the insurance won’t cover it. We hear this all the time. Unless your roof is specifically excluded for coverage on your policy, the age of the roof has no bearing on coverage. If anything an older roofing shingle will most likely be too brittle to repair and increase the chance of your insurance needing to pay for full replacement rather than repair.

I need to get estimates before I file a claim. Although your certainly welcome to do so, this is not necessary. Typically if an insurance company asks you get collect estimates before sending out an adjuster it’s because they are hoping that either this will prove difficult and you won’t pursue a claim, or you will be able to find an estimate that is below market value. Remember, your insurance carrier does not want to pay out on claims. Every adjuster has access to industry standard pricing that tells them the agreed upon value of any work that needs to be performed and should provide you with an estimate.

I need to call my agent to file a claim. Insurance claims are never handled by your insurance agent. If you want to call your agent for advice or guidance in the process feel free to do so, but expect in very rare, usually escalated situations, adjusters, not agents, process all claims.

My roof is leaking, so my insurance will replace it. As much as we wish this were case, keep in mind that your insurance will only cover roof replacement or siding replacement in cases of damage. If you roof is leaking because of an improper installation or just due to aging shingles or flashing, your insurance is not likely to cover a replacement. If you are experiencing a leak though give us a call and we can inspect your roof at no cost!